- Base Date: Nov 10, 2020

- Reference: Yahoo Finance, Google Finance

1. Dividends History

Dividend King Coca-Cola has been an increase in dividends every year.

2. Dividend Band(1962~)

- Coca-Cola Dividend band: 0.67%~4.52%(1962~)

- YTD, 3years, 5years Dividend Band: 2.73%~4.52%

- 10 Years Dividend Band: 2.51%~4.52%

3. CAGR

- 3years dividend CAGR: 4.55%, Stock Price CAGR: 4.93%

- 5years dividend CAGR: 5.77%, Stock Price CAGR: 4.29%

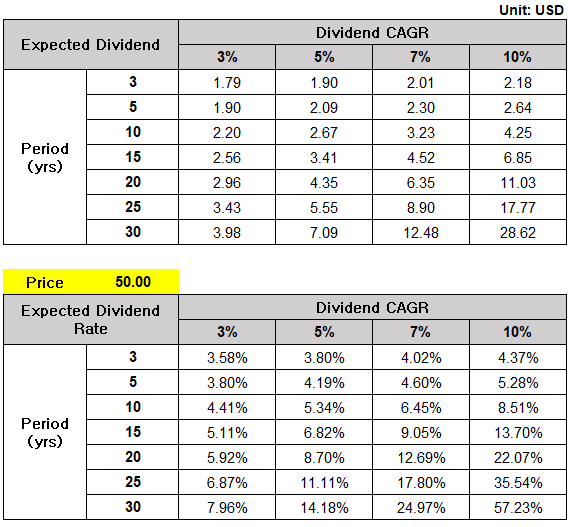

- Refer Below table

4. Exptected Dividends & Rate

- If KO Dividend CAGR is 5% and investment period 30 years, KO dividend after 30 years: 7.09 USD

- If KO Dividend CAGR is 5% and investment period 30 years, KO dividend after 30 years Dividend rate(Price 50 USD): 14.18%

5. Proper Price to meet expected dividend rate

- Condition: CAGR 5%, Price 50 USD

6. Dividend Yield

7. PDR Chart

Price Dividend Ratio(PDR) is stock price is divided by the dividend per share. Coca-Cola(KO) PDR Charts is as below charts.

8. Backtest(1962~)

- Reinvest Dividneds: Yes

- Backtest Result: CAGR 12.68%, Total Return: 38.690%

'주식 > 해외주식' 카테고리의 다른 글

| 아마존은 돈은 어떻게 벌까? 아마존의 비즈니스 모델과 실적 (0) | 2020.11.06 |

|---|---|

| 구글 광고의 힘으로 예상치 상회한 실적! (16) | 2020.10.30 |

| 해외주식 실적발표일정 (7) | 2020.10.28 |

| 독일 시가총액 1위 SAP(Ticker: SAP) 배당과 백테스팅, 그리고 퍼포먼스 알아보기 (1) | 2020.10.19 |

| ERP & CRM 절대강자 강자, 독일 시가총액 1위 SAP(Ticker: SAP) (2) | 2020.10.15 |